Here is a guest column provided by BlueBay Asset Management. The authors are Mike Reed, partner, senior portfolio manager; Pierre-Henri de Monts de Savasse, portfolio manager, and Lydia Chaumont, partner, head of client portfolio and relationship management. They talk about the opportunities that arise in the space of convertible bonds, which are hybrid financial instruments containing the ability to convert from debt to equity .

Keeping portfolios on-track with their return objectives can require rotation to reflect the changing investment environment. With equity long/short hedge funds having delivered disappointing returns in recent years, whilst continuing to charge high fees, convertible bond funds are emerging as a potentially attractive and cheaper alternative.

What you need to know

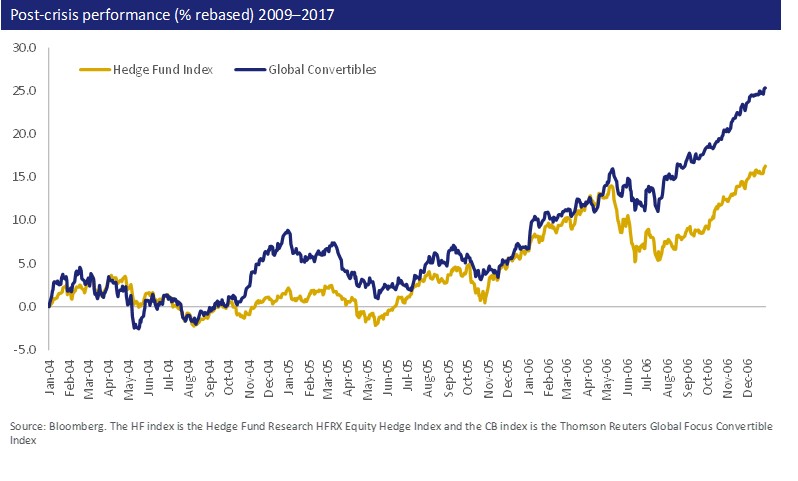

-- Prior to the global financial crisis, the performance of convertible bonds was closely correlated to long/short equity hedge funds – CB 7.8 per cent annualised, L/S HF 5.2 per cent annualised ;

-- Post the crisis, convertibles have significantly outperformed L/S HFs with limited downside while charging lower fees – CB 6.7 per cent annualised, L/S HF 2.4 per cent annualised .

-- The volatility profiles of the two asset classes have been very similar over both periods – pre-crisis CB 5.6 per cent vs L/S HF 4.9 per cent; post-crisis CB 6.8 per cent vs L/S HF 5.8 per cent.

Traditional investments typically fall into two categories – equities and fixed income. A host of alternative investment instruments and approaches, which provide portfolio construction options to help diversify returns and reduce correlation, complement more conventional holdings. These include private equity funds, hedge fund strategies, commodities, property and infrastructure investments. Their return characteristics differ to those of equities and bonds and have the potential to improve the overall risk/return profile of a portfolio. Convertible bonds are hybrid instruments, combining features of both equities and fixed income.

A convertible bond has standard fixed income features, such as a fixed coupon and redemption date; however, embedded in the security sits the option to exchange the bond for a predetermined number of shares at a later date. It is this switch opportunity that can make convertibles more interesting than traditional pure bond or equity exposures.

The best of both worlds?

Convertibles have historically been used by fixed income investors seeking to capitalise on the growth potential offered by the equity market via the embedded option, or by equity managers looking to lower the volatility of their portfolios by holding what is in essence a bond buffer. Convertibles have also been used by dedicated convertible arbitrage funds as the basis for a standalone strategy, which seeks to extract value directly from the embedded option by hedging many or all of the various other quantifiable risks.

More recently, plain vanilla convertible long-only funds are being considered as a replacement for allocations to L/S HF investments, a move that appears to have fundamental logic supporting what may initially appear to be an unusual allocation strategy.

Convertible bond funds behave like equity long/short hedge funds

L/S HF seek to generate performance by establishing both long and short positions in a range of different companies, but very few are truly "equity neutral". Historically the majority of managers ended up creating a net long bias, as is evident from their positive correlation with equity markets. As such, funds tend to benefit from equity market appreciation, but generally have some participation in equity market falls. This profile echoes the dynamics of convertible bonds i.e. both asset classes are long equity beta - tracking equity markets on the upside - but provide a degree of protection against downward market moves. Comparing the performance of L/S HF against the most widely followed global convertible bond index between 2004 and 2007, the numbers are strikingly similar.

In the bull market years up to 2007, both assets tracked higher with similar return profiles. However, when the global financial crisis of 2008 hit, although both asset classes retraced, they provided a very similar degree of downside protection - global equities lost 43.5 per cent whereas L/S HF were down 25.4 per cent and the CB index fell 26.2 per cent.

Convertibles matching then outperforming equity

L/S HF Investing in the post-crisis world Convertible bonds have dramatically outperformed L/S HF since 2008 returning 6.7 per cent annualised against L/S HF 2.4 per cent annualised . Correlation remains high though, as both tend to gain in rising equity markets but suffer in pullbacks. There are many possible explanations for the underperformance of L/S HF over this period; prime brokers now offer more limited access to leverage, the cost of that leverage is higher making individual trades less compelling and the cost of implementing new regulation continues to grow.

We believe these factors will continue to affect the ability of hedge fund managers to generate pre-crisis type returns. In the current investment environment, where investors are focused both on returns per unit of risk and on the fees they pay to fund managers, asset allocation decisions are coming under increased scrutiny. We believe convertible bonds currently present a more attractive investment profile than allocations to L/S HF. Why? We have seen that in the post-crisis era, convertible bonds have captured the equity upside more efficiently than equity L/S HF while maintaining downside protection during pullbacks.

Additionally, although we do not believe investment allocations should be driven by fund pricing structures, there is a growing body of evidence that shows higher costs can have a materially negative impact on long-term returns. Portfolio management costs for long-only convertible investors are generally a fraction of the "2 and 20" model traditionally charged by hedge funds, tilting the potential participation in future returns further in favour of convertible bonds. We believe now is the right time for investors to review their choices when it comes to alternative allocations.

In the post-crisis era, long/short equity hedge funds have struggled to generate compelling returns, while convertible bond portfolios have continued to participate in equity upside while offering protection when markets dip. Given their lower fee structure and our view that convertibles are likely to continue to generate attractive risk adjusted returns, now could be an opportune time for investors to switch allocations in their alternatives bucket from equity long/short into a long-only convertible fund.

Footnotes:

1, From 1 January 2004 to 1 January 2007, as measured by the Hedge Fund Research HFRX Equity Hedge Index and the Thomson Reuters Global Focus Convertible Index

2, From 1 January 2009 to 30 September 2017